Sovereign Wealth Funds are state owned entities that are used as an investment vehicle by a state, and where the original investment funds are usually derived from state generated sources. SWFs in turn make investments into a variety of real and financial assets such as stocks, bonds, real estate, commodities, private equity, and other trading arrangements. They invest both in their domestic markets and also increasingly on a global basis, and are important funding and investment sources alongside traditional investors.

SWF: Aims And Objectives

It is important to understand that SWFs have additional aims and objectives, and different characteristics, when compared with other investors. These manifest themselves in the way SWFs formulate and adopt their risk policies (including appetites and tolerances), the manner of their investment, their liquidity requirements, the length of their investment timelines and how they organise other priorities.

Occasionally, these priorities can include environmental, social, and corporate governance (ESG) aims. In particular, an SWF may look at the societal benefits of an investment and not just the obvious economic or financial benefits.

Click here to read the full article in our latest International News.

read more

Subscribe

Subscribe

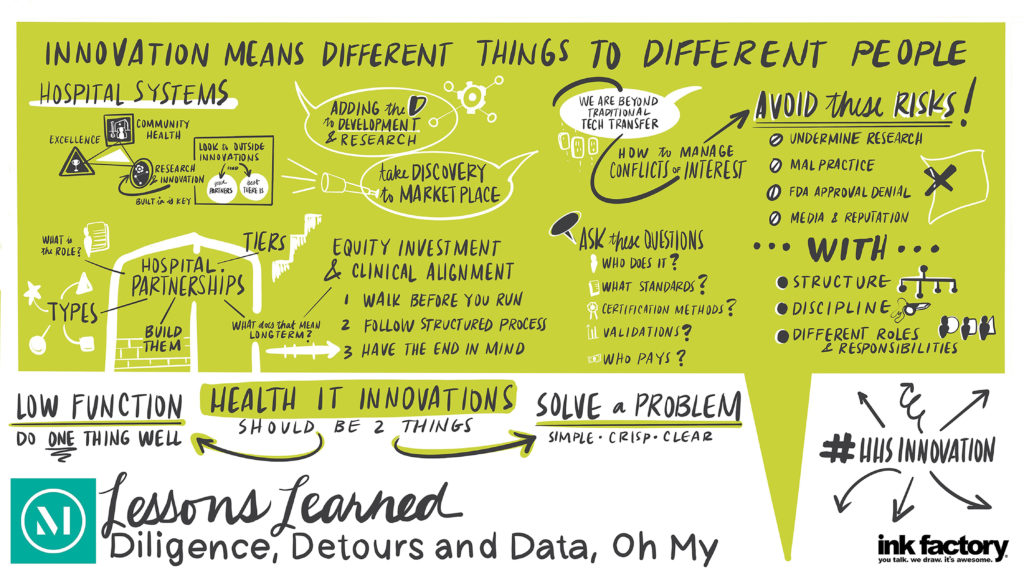

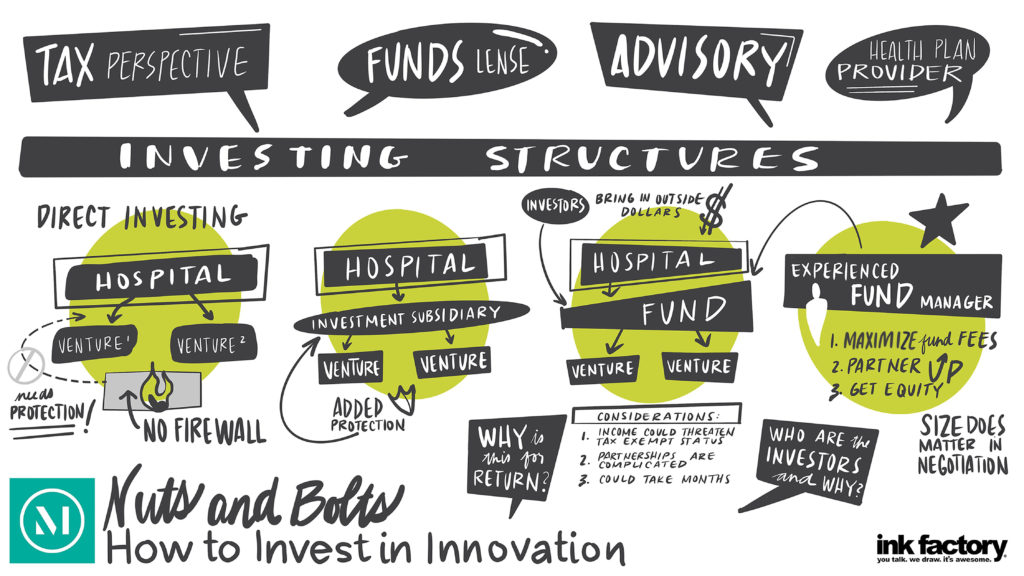

There has been increased interest by hospitals and health systems in creating innovation centers and making innovation center investments, which are helping to transform the healthcare landscape. As they enter this space, hospitals and health systems must first decide how to organize to capitalize on and commercialize innovation opportunities to get innovations into the routine of patient care.

There has been increased interest by hospitals and health systems in creating innovation centers and making innovation center investments, which are helping to transform the healthcare landscape. As they enter this space, hospitals and health systems must first decide how to organize to capitalize on and commercialize innovation opportunities to get innovations into the routine of patient care.